Taxes

These are fees paid by individuals or businesses to support their government. These can have a significant impact on the viability of a project. If an investment yields a profit, the profit is taxed.

This is another expense in the cash flow diagram.

This is essentially

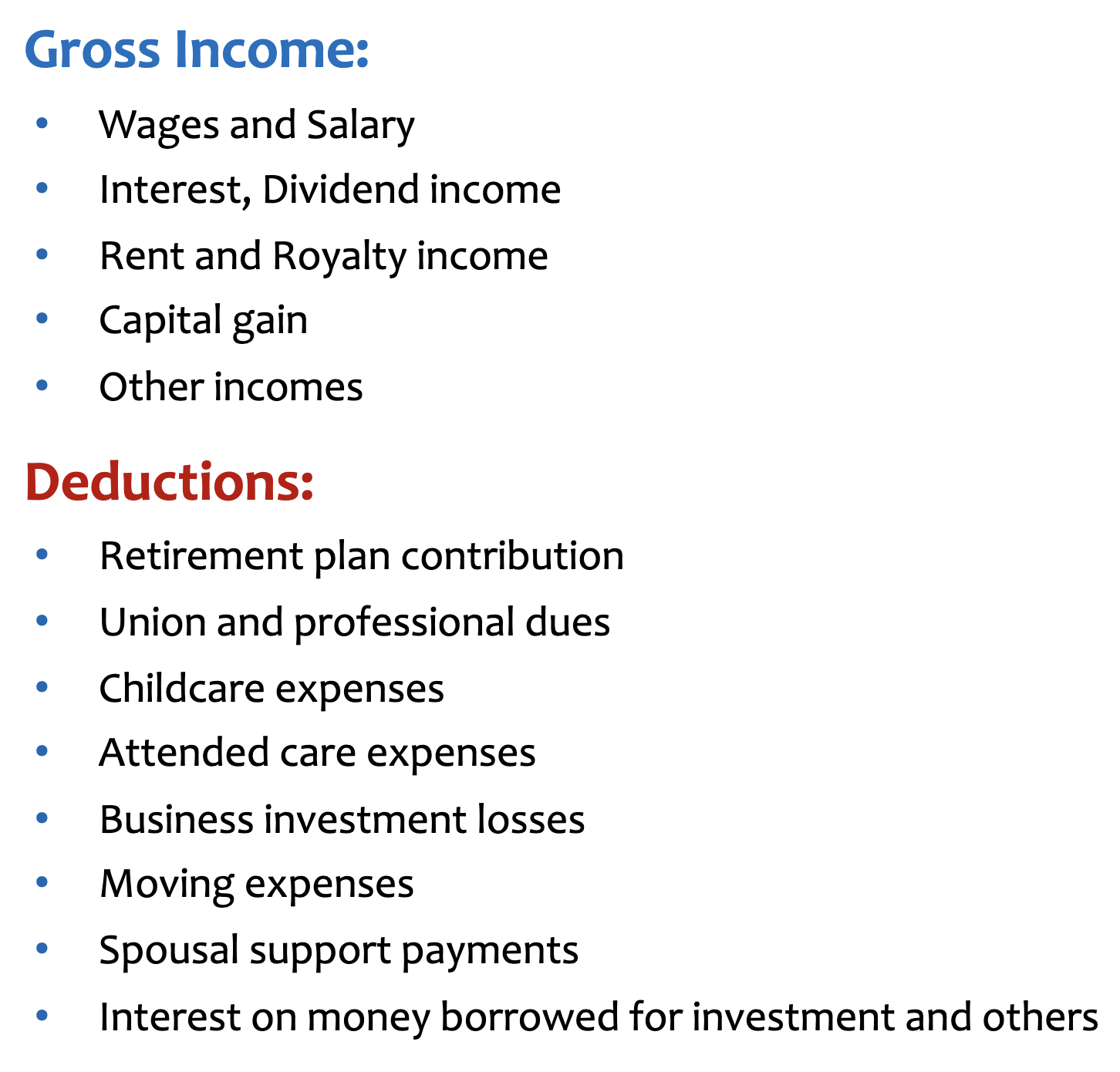

What is gross income and what are deductions?

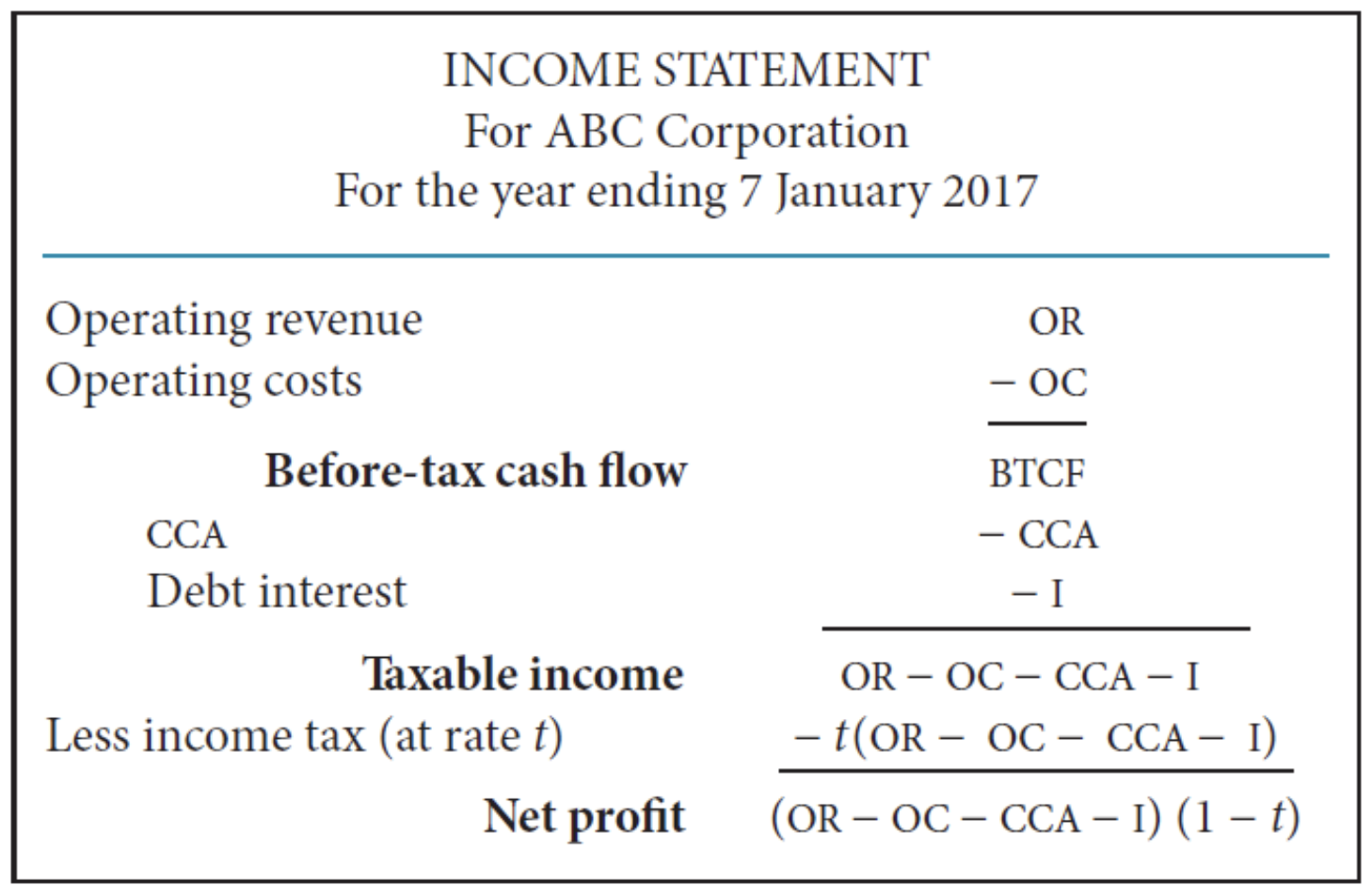

Corporate Income Tax

- Net income is based on gross income less expenses

- Tax rates flat and depends on the size of the corporation (35-60%)

- The presence of capital expenses

Corporate Tax Rates

- We will focus on corporate tax rates

Some definitions…

- CCA = Capital Cost Allowance

Before and After Tax MARR

- Taxes reduce profits, so we need to set the appropriate after-tax MARR for project acceptability

- If the impact of taxes is explicitly accounted for, then the MARR used for the project must be the after-tax MARR

-

- This relationship is a simplifications since in reality, these are often chosen independently For Tax Inclusion

- We need to consider 2 approaches:

- SLD Approach

- We consider the SLD concept for Capital Cost Allowance

- In general, we exclude the salvage value and depreciate the capital cost by SLD over the course of the useful life and that will create tax credit (something that increases tax) as capital cost allowance (CCA)

- In practice

- Where we don’t include S in this equation

- We do this for the first cost for example since that is a present worth

- For all other cash flows, multiply them by

- Ex. for Salvage Value multiply by

- Note: ATCF = After tax cash flow

- Now compare if its greater than 0, if so, its justified

- IRR After Tax

- Approximately

- Accurately (Just normal IRR but get the PW after tax)

- (Canadian Approach) CCA Approach

- The depreciation rate (basically d) is the CCA rate provided by the government for a class of asset

- Engineering projects are often of class 8 → 20% DB

- The remaining value is called the Undepreciated Capital Cost (UCC)

- Capital Tax Factor (CTF)

- This is the total acquisition cost (including installation, transportation, and other things unrelated to the value of a thing)

- As an asset depreciates, the company keeps track of UCC which may differ from market or salvage value

- The Canadian tax system uses a half-year rule in the year of purchase, and only half of the usual depreciation is applied

- As long as the business is operating the books stay open and the CCA calculations go on infinitely

- which is used to calculate the present worth using the CTF method below…

- Here, the value in the bracket is called the capital tax factor

- Capital Salvage Factor (CSF) =

- Where

- To convert a before tax cash flow to an after tax cash flow

- Multiply costs and revenues by

- Multiply the first cost (initial investment) by the CTF

- Multiply the salvage values by the CSF

- Then apply PW or AW analysis to the project

- For tax credits

- A loan provides a tax credit, here we only consider the interest amount

- The interest amount annually is

- Then we multiply , since we want to know the amount of tax that we are not paying

- We can now use a factor to discount this annuity back to the present value

- SLD Approach